2022 annual gift tax exclusion amount

2 2 2179 Reply. 12060000 DSUEA 1.

Tax Related Estate Planning Lee Kiefer Park

The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022.

. Gift and estate tax applicable exclusion amount. The IRS has announced that the annual gift exclusion will rise to 16000 for calendar year 2022. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted.

What per person per person means. 159000 164000 Generation-skipping transfer GST tax exemption. 1 1 2152 Reply.

March 10 2022 600 am ET. The 2021 exemption amount was 73600 and began to phase out at 523600 114600 for married couples filing jointly for whom the exemption began to phase out at 1047200. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayers lifetime exemption amount.

No one has any clue as to what the annual gift tax exclusion or lifetime limit will be in the 2022 tax year. The Internal Revenue Service has announced that the annual gift tax exclusion is increasing next year due to inflation. There has been No legislation passed which would change the amount of gift that can be given in 2022 from the current exclusion amount of 15000 per individual per year.

In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021 meaning a person can give up 16000 to as many people as they want without having to pay any taxes on the gifts. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year.

2021 and 2022 gift and estate tax. The specific amount is known as the annual gift exclusion. The gift and estate exemption is unified meaning it includes both an individuals lifetime taxable gifts and.

Gifts of less than the annual gift exclusion are passed on tax-free while gifts over the exemption amount could be subject to the unified gift and estate tax. Every taxpayer has a lifetime gift and estate tax exemption amount. For 2022 the annual gift exclusion is being increased to 16000.

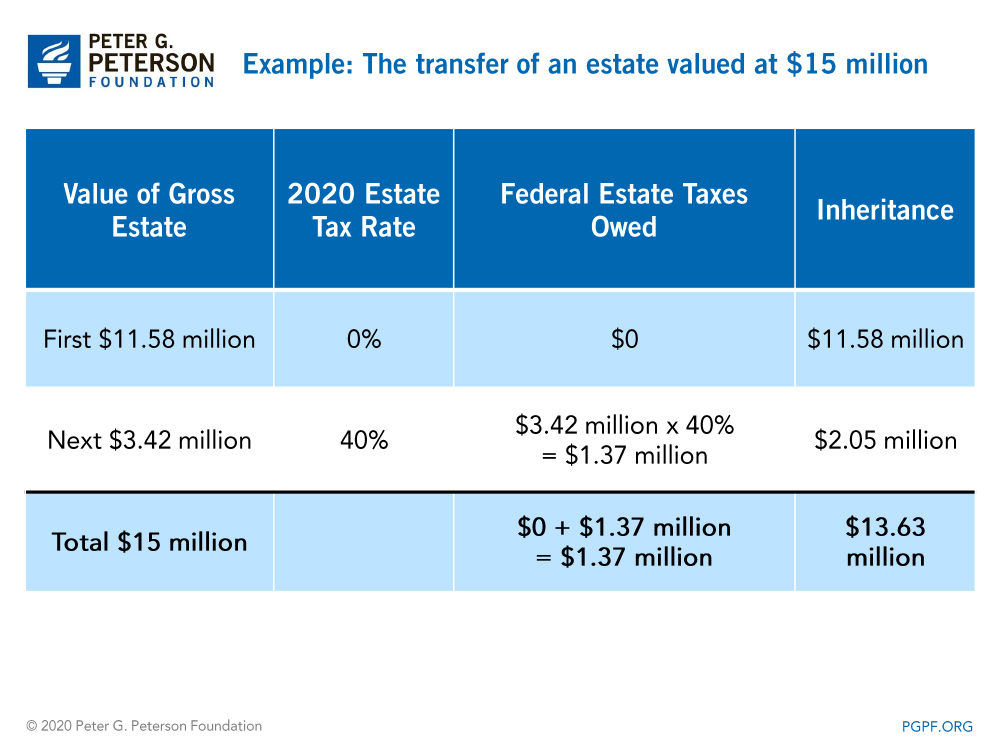

The maximum rate of the federal estate tax is 40 percent so it can have a significant impact on your legacy. There is a common misconception that you must pay gift taxes if you give away more than the annual exclusion to a single recipient. The amount an individual can gift to any person without filing a gift tax return has remained at 15000 since 2018.

On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. For the past four years the annual gift exclusion has been 15000. How the gift tax is calculated and how the annual gift tax exclusion works.

The estate and gift tax lifetime exemption amount is projected to increase to 12060000 currently 11700000 per individual. The federal estate tax exclusion is also climbing to more than 12 million per individual. The gift tax annual exclusion in 2022 will increase to 16000 per donee.

11700000 DSUEA 1. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022. It increased the exclusion from 549 million to 1118 million.

The IRS formally made this clarification in final regulations released that day. For married couples the exclusion is now 24120000 million. That tax is usually paid by the donor the giver of the gift.

The federal estate tax exclusion is also climbing to more than 12 million per individual. Noncitizen spouse annual gift exclusion. The annual gift exclusion is applied to each donee.

In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS about it. According to the Wolters Kluwer projections in 2022 the gift tax annual exclusion amount will increase to 16000 currently 15000 per donee. The amount you can gift to any one person on an annual basis without filing a gift tax return is increasing to 16000 in 2022 the first increase since 2018.

In addition the basic estate tax exclusion amount for the estates of decedents dying during calendar year 2022 will be 12060000. The amount an individual can gift to any person without filing a gift tax return has remained at 15000 since 2018. Further the annual amount that one may give to a spouse who is not a US citizen will increase to 164000 in 2022.

This is of particular interest to families with special needs because the ABLE contribution cap is tied to the annual gift tax. After four years of being at 15000 the exclusion will be 16000 per recipient for 2022the highest exclusion amount ever. The Gift Tax Annual Exclusion increased by 1000 in 2022.

There have been inflation adjustments each year since then and in 2022 the exclusion is 1206 million. We expect the IRS to release official figures near year-end. In 2022 the lifetime exemption increased from 117 million to 1206 million.

GiftEstate Tax Lifetime Exemption. The gift exclusion applies to each person an individual gives a gift to. The exclusion is portable and this means that a surviving spouse.

The federal estate- and gift-tax exemption applies to the total of an individuals taxable gifts made during life and assets left at death. The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022. Annual Gift Tax Exclusion The IRS allows individuals to give away a specific amount of assets or property each year tax-free.

What is the gift tax annual exclusion amount for 2022. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

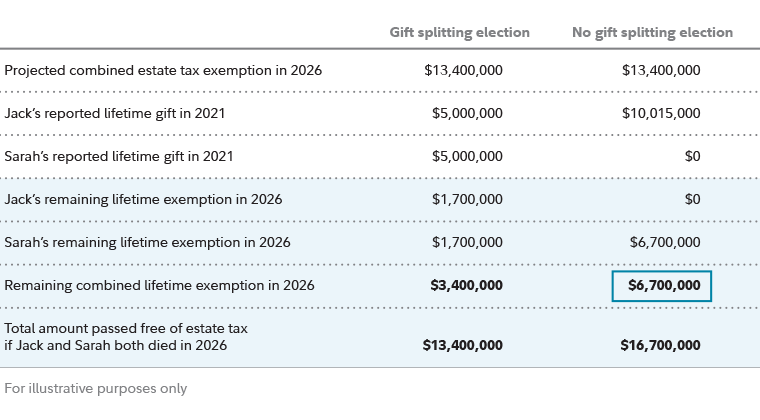

Estate Planning Strategies For Gift Splitting Fidelity

How Does The Gift Tax Work Personal Finance Club

Irs Announces Higher Estate And Gift Tax Limits For 2020

What Are Estate And Gift Taxes And How Do They Work

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Are Estate And Gift Taxes And How Do They Work

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning

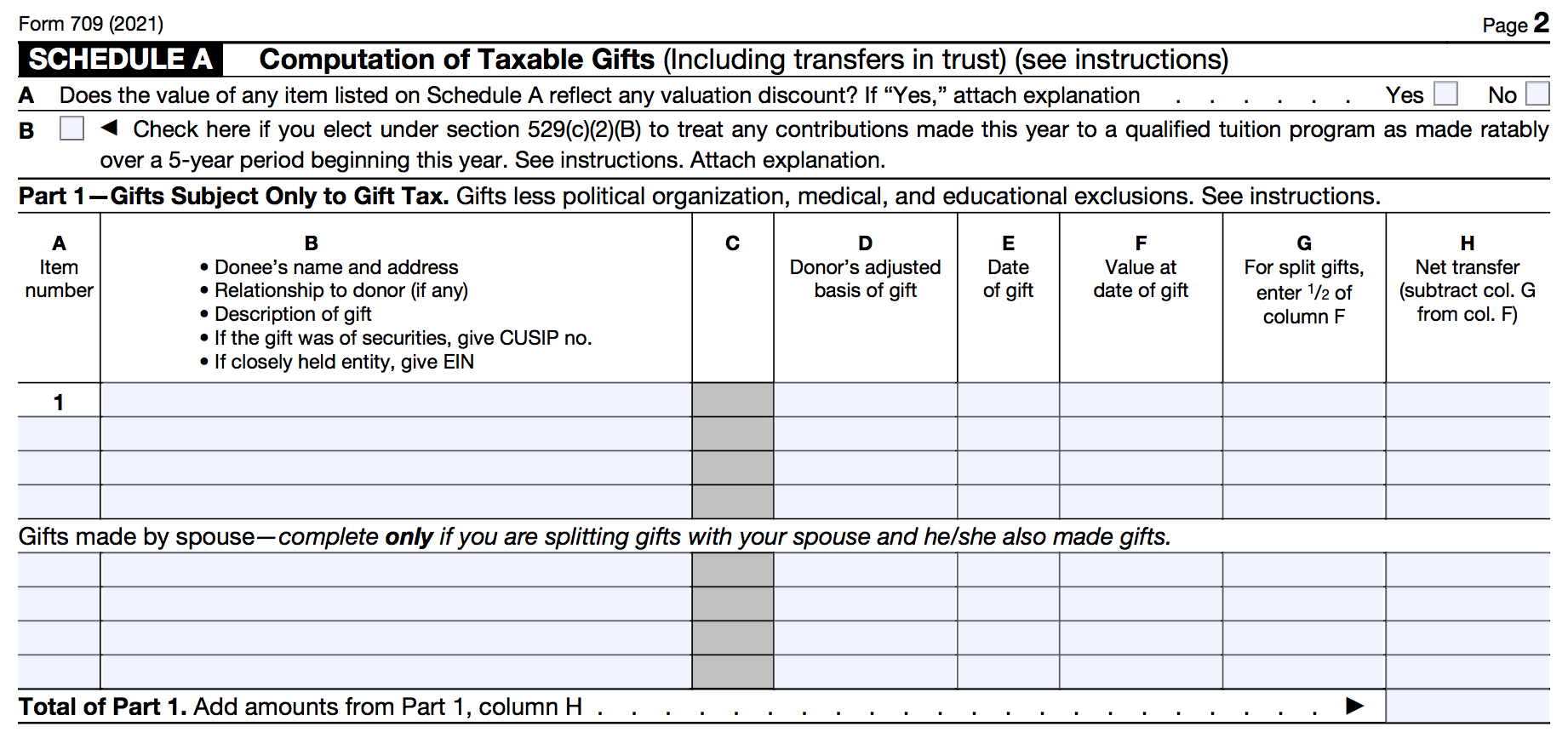

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Gift Tax How Much Is It And Who Pays It

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Estate And Gift Tax An Overview Findlaw

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Gift Tax The Annual Exclusion And Estate Planning The American College Of Trust And Estate Counsel

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022